Social security wep calculator

Estimate if you are eligible for a pension based on work that was not covered by Social Security. Rental price 70 per night.

Cpp U S Social Security And Wep

Skip advert There are ways you can lower.

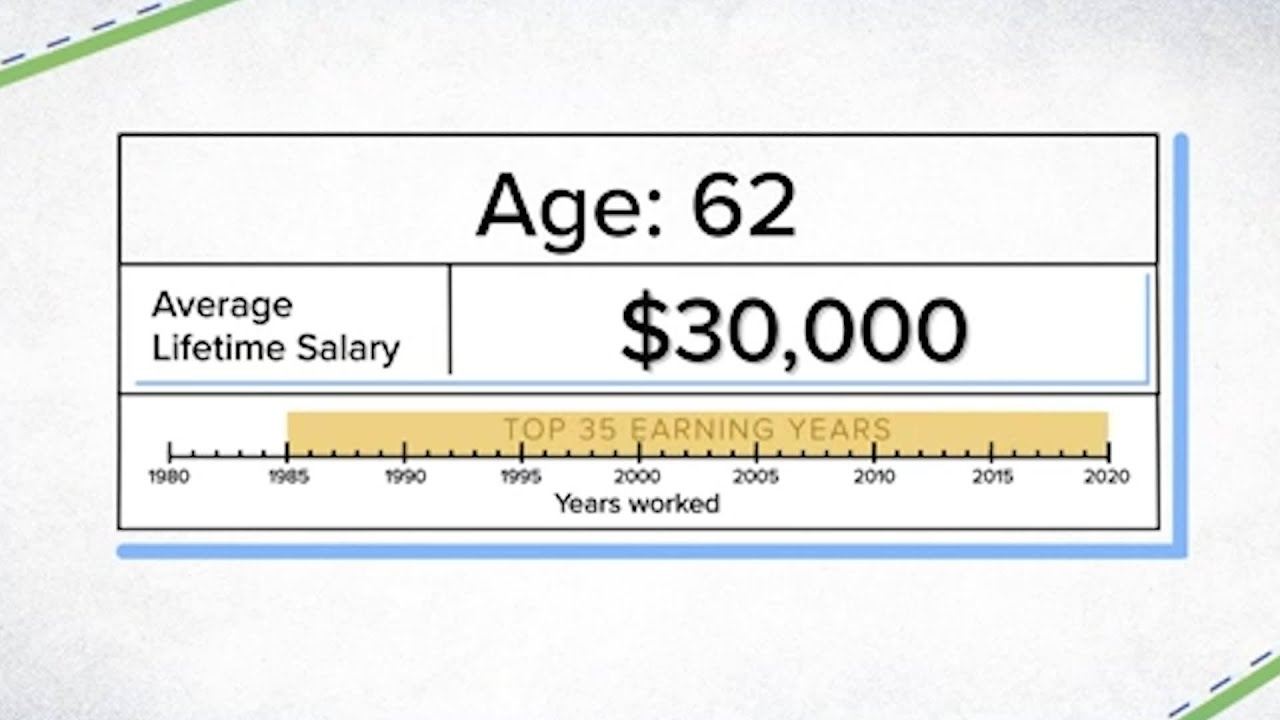

. While WEP cannot completely eliminate your Social Security benefit it can reduce it to a very small amount. The WEP is simply an alternate formula for calculating Social Security benefits for those who have a pension from a job where no Social Security taxes were paid. Civil service was brought under the Social Security system.

Keep in mind. What is the maximum WEP reduction if I am currently due to get 1040 a month in retirement starting in March 2021. It takes into consideration the amount of your pension and then decreases the amount of your Social Security by a factor.

The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement benefits for workers who also collect a non-covered pension from a job in which they didnt pay Social Security taxesThe provision affects about 19 million Social Security beneficiaries. Windfall Elimination Provision WEP Government Pension Offset GPO.

I live in Texas which is a Windfall Elimination Provision state. You enter the amount of your pension and the amount of spousal. This calculator will tell you.

The Windfall Elimination Provision WEP and the Government Pension Offset GPO are two components of the Social Security benefit calculation process. For Medicare began 1966 1971-1980 2142. Each provision when applicable will reduce.

The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. A non-covered pension earned by your spouse has no bearing. Your benefit may be offset by the Government.

We hope this explanation. The WEP may apply if you receive both a pension and Social Security benefits. The WEP provision will not eliminate all Social Security or Medicare eligibility if the worker has 40 quarters of qualifying income.

This document will help you understand how pensions based on such earnings affect Social Security benefits. Urban Institute economists C. Windfall Elimination Provision WEP Calculator.

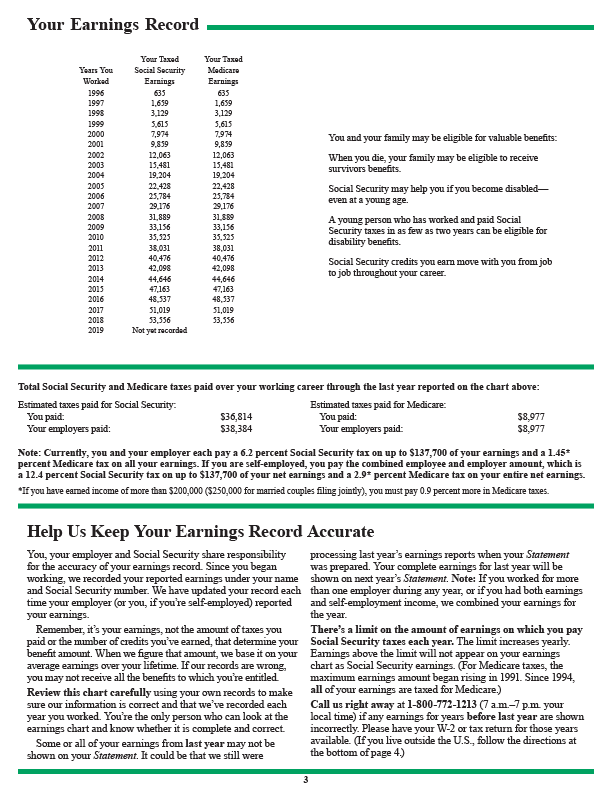

You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement. From 1940 to 2001 the SSA supplemented service members pay records with special earnings credits. Social Security benefit rules are different for people who had a job that was not covered by Social Security and receive a pension because of that job.

A Social Security break even calculator can help with the decision but it can never be the sole factor used if you are serious about making a well-rounded decision. Thats considered double-dipping and thats what the WEP is intended to prevent. If you work or have worked for a company that gives you a pension based on work not covered by Social Security the basic calculators above arent an accurate representation.

Estimate of spouse benefits for yourself if you receive a pension from a government job in which you did not pay Social Security taxes. Handles all Social Security benefits for ALL households. Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected.

For more information about how WEP works and a list of exceptions review the Windfall Elimination Provision PDF and use the WEP Calculator to see how your Social Security benefit may be affected. In some circumstances past military service could boost your Social Security payment. These rules apply only if you are collecting a non-covered pension based on your own work and some kind of Social Security benefit.

You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. The age you claim benefits will affect the benefit amount for your surviving spouse. If you earned 50000 per year in a 35-year career you would have paid around 110000 in social security taxes.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. The Social Security WEP Calculator. Also lets not forget that your employer would have paid the same amount of taxes on your behalf which means that there would have been nearly 220000 paid in social security taxes throughout your career.

Eugene Steuerle and Adam Carasso created a Web-based Social Security benefits calculator. Full retirement age. Using the GPO calculator is quite simple.

I am a federal government retiree with 40 years of service which includes military and civilian service. Economic Security Planning Inc. It includes a link to an online WEP calculator that can tell you how your Social Security benefits may be affected by your non-covered government pension.

The WEP calculator and GPO calculator at Social Securitys website can help you estimate how much these rules will cut into your benefit. See what else you can do online at SocialSecuritygov. The impact of such earnings on Social Security benefits.

As with military retirement pay receiving VA disability benefits does not have an impact on Social Security benefits but can affect SSI eligibility and payments. Social Security Retirement Calculator to estimate spousal benefits. Social Securitys online services are here to put control at your fingertips.

The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP. The WEP and GPO can be awful surprises so Im glad youve taken. The WEP primarily affects retirees from some state and local government bodies and federal workers hired before 1984 when the US.

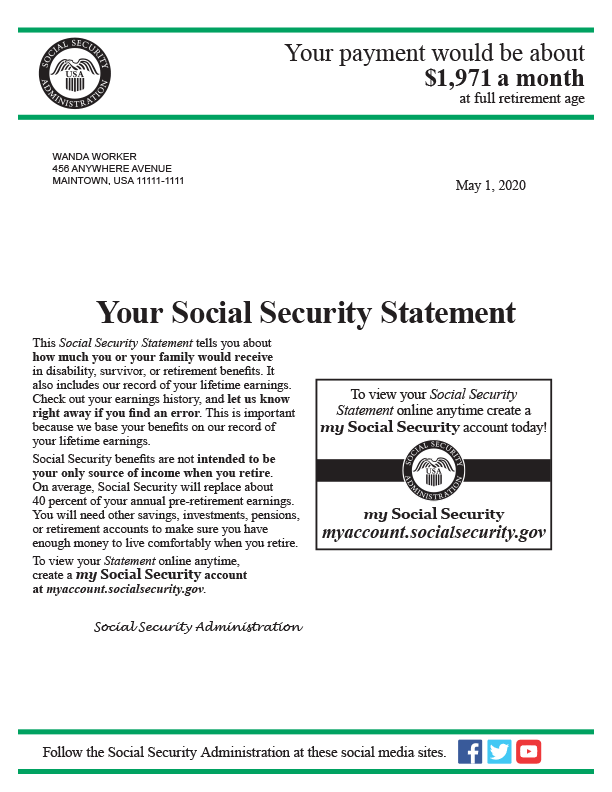

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount. If you had between 20-30 years of substantial earnings covered by Social Security the WEP may still apply but at a reduced level. If in the course of your career you worked for both 1 at least one employer that did withhold Social Security taxes and 2 at least one employer that didnt withhold Social Security taxes and that offers a pension the windfall elimination provision WEP may come into play.

Easy-to-Use Social Security Calculator. Todays Social Security column addresses questions about whether the earnings test can a spouses benefit changing benefit payment dates and a foreign. About 19 million people or 3 percent of Social Security recipients have their benefits reduced by the WEP according to the Congressional Research Service.

Using this calculator it is possible to estimate net Social Security benefits ie. Without the WEP this individual would qualify for a high-percentage Social Security benefit as well as a good pension. Also I have 12 years of service contributing to social security.

You will need a.

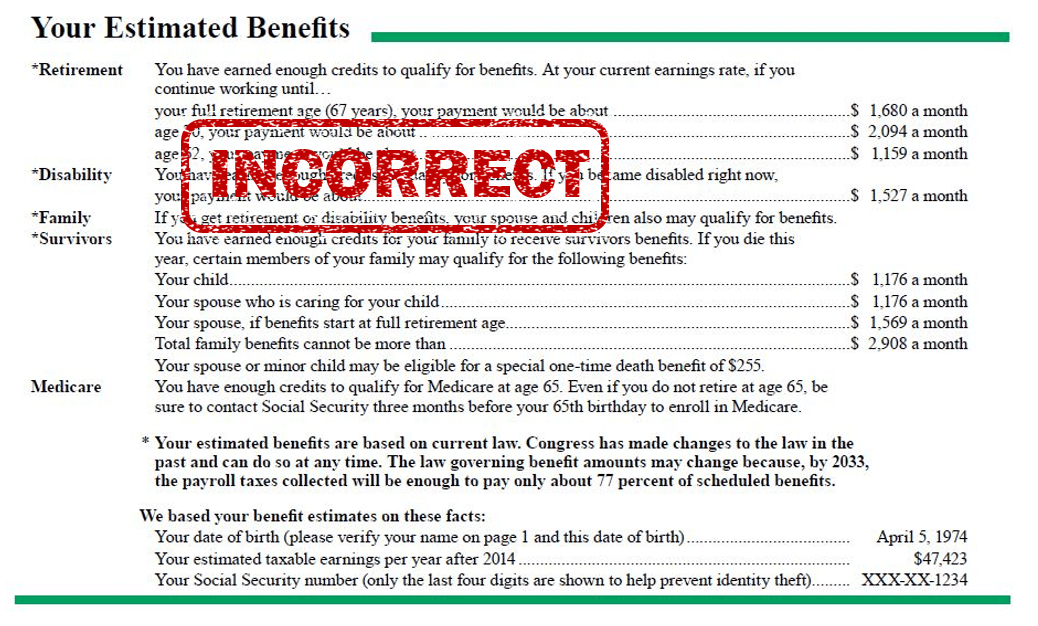

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

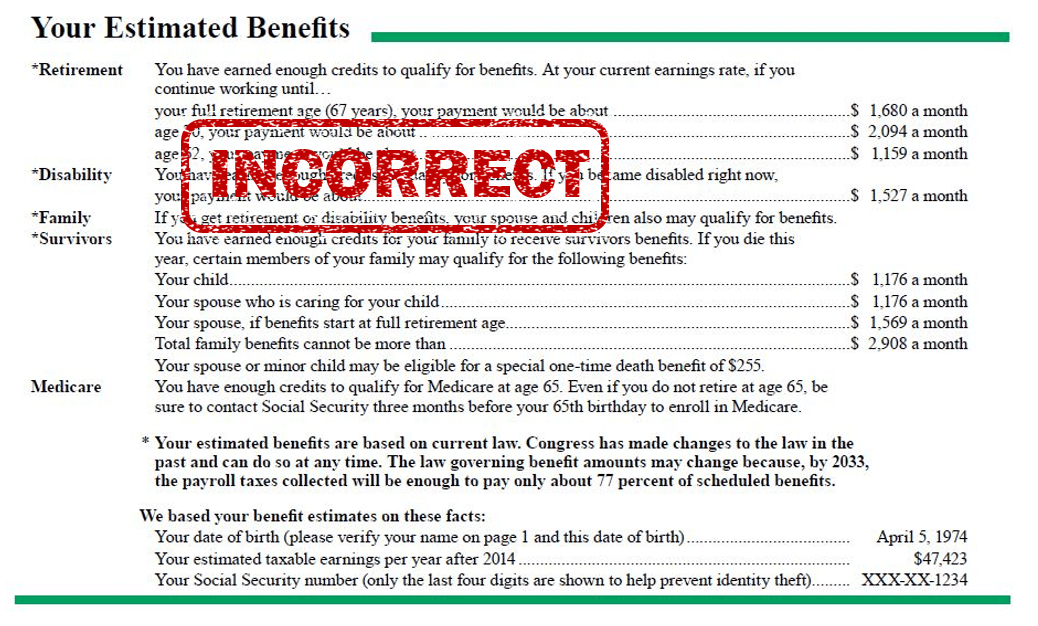

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

Program Explainer Government Pension Offset

/GettyImages-1168040757-a6d3558ed29143169ae1081b749fc2e2.jpg)

11 Social Security Calculators Worth Your Time

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

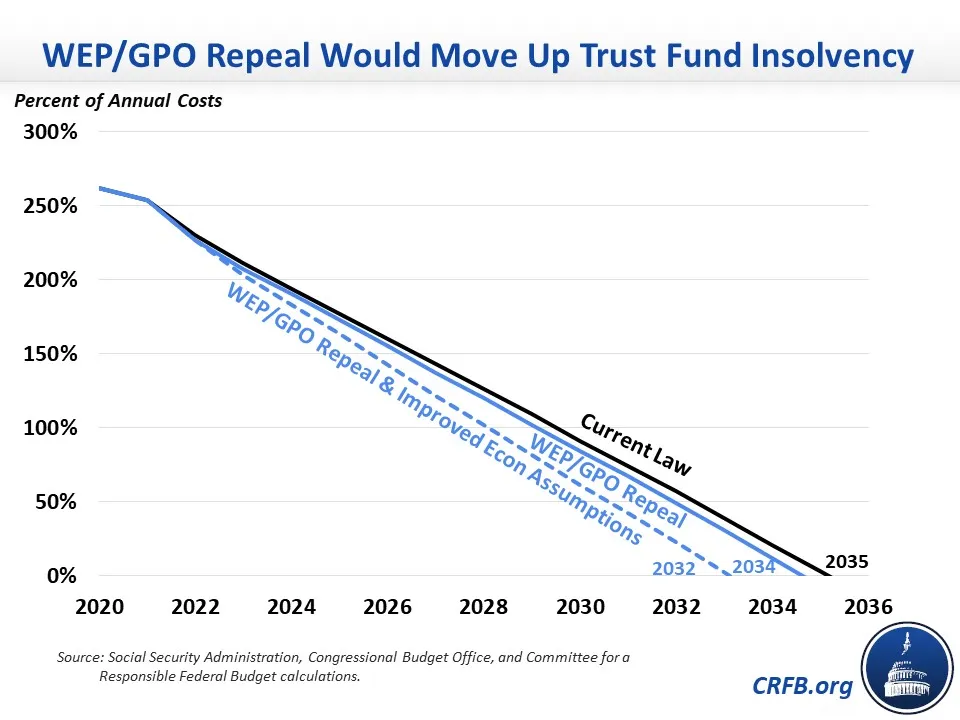

Wep Gpo Repeal Would Mean Earlier Insolvency For Social Security Committee For A Responsible Federal Budget

Analysis Of Benefit Estimates Shown In The Social Security Statement

How The Social Security Windfall Elimination Provision Wep Impacts Pension Payments Carmichael Hill

The Windfall Elimination Provision Plus The Two Most Common Ways To Sidestep Youtube

Analysis Of Benefit Estimates Shown In The Social Security Statement

How Wep Can Affect A Person S Social Security

The Windfall Elimination Provision Wep In Social Security Comparing Current Law With Proposed Proportional Formulas Everycrsreport Com

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

The Social Security Windfall Elimination Provision Issues And Replacement Alternatives

Us Social Security Benefits For Canadians Le Calcul Riche